That may be hard to believe when one looks at the continued year-on-year deficits in arriving import TEUs. The situation reached its nadir in February and March when deficits bottomed out at about 35% below the prior year. Things have improved somewhat since then; May came in “only” 20% below 2022.

But these deficits include the effects of the overall softness of the current market, as compared with the superheated activity that still prevailed last year at this time. The key questions are how much share is the USWC clawing back in this soft market, and how does current USWC volume compare with “normal”? Using these measures, the news is better.

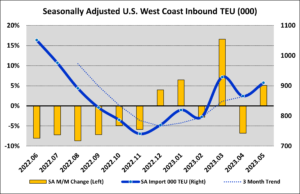

In absolute terms, USWC import TEUs bottomed out in February. Since then, import volume has increased for three straight months. Import TEUs in May were 41% higher than in February. But the seasonally adjusted data tells an even better story. Based on pre-pandemic seasonality, the bottom occurred in November, and the trend has been generally up since then, as shown in the first chart. While the progress has been uneven, the overall trend is clear. Even though unadjusted volume dropped from November to February, the decline was less than what one might expect in a normal year. So, after seasonal adjustments, volume was moving up.

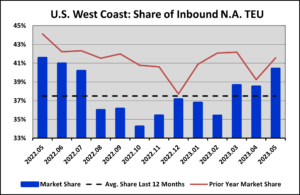

Another meaningful measure is the USWC’s share of import TEUs arriving. This analysis tells much the same story, as shown in the second chart. USWC share of US plus western Canada import TEUs reached its nadir of 34.2% last October and has been moving up since. In May, it was back up to 41%, about even with the prior year.

Importers eager to return to West Coast

The message is that the doom and gloom regarding the USWC may have been excessive. As Mark Twain is famously reputed to have said, “The report of my death has been grossly exaggerated.” Importers today have become adept at reacting to short-term disruption. Their diversified port strategies have enabled them to reroute freight bound for the nation’s interior in order to ensure service and dodge delays. However, they are not eager to permanently adopt higher-cost routings when a reliable lower-cost option with reasonable service exists.

It would not be surprising if this recovery trend experiences a setback or two in the next couple of months. The USWC disruptions that took place just prior to the contract settlement may have spooked some importers and caused them to dial back on their West Coast shipments. The effect of such decisions will be seen over the next month or two when that diverted freight reaches there. But such hiccups will be short-lived.

The data indicates that importers were, in fact, eager to return to the USWC and began to do so in advance of an agreement, based simply on the expectation of a settlement. This bodes well in the near-term, as overland options via the West Coast take back share from all-water routing via the Panama Canal. The drought-related draft restrictions on the Panama Canal will contribute to the recovery.

On the other hand, the longer-term trend has clearly been toward the East, and that can be expected to continue. Disengagement from China is slowly rewriting the freight map, and volume will move toward sourcing locations more conducive to reaching the US via the Suez Canal and the East Coast. A near-term recovery will not mean that the long-term threat to the USWC has been abated.

Contact Larry Gross at lgross@intermodalindepth.com.