There has been a great deal of discussion in the press recently regarding the current state of the intermodal market. Has the inventory drawdown run its course? Will the market come back in time for the peak season?

These are certainly valid questions, but the answers lie outside of the intermodal sector’s control.

However, regardless of where the demand for intermodal and truckload freight transport moves over the coming months, the industry holds the key to its destiny in its own hands. It’s all about market share. Even a partial recovery will result in big gains.

I produce an estimate of intermodal market share each quarter. In this task, I am assisted by Noel Perry of Transport Futures, who provides his industry-leading data on the trucking industry. Each quarter he uses a variety of economic data to generate estimates for the US dry van and reefer van truckloads.

For the purpose of creating an intermodal market share estimate, truck movements of less than 500 miles in length are excluded, cutting out about 78% of the US heavy-duty trucking market. The intermodal numbers come from the Intermodal Association of North America ETSO database and include all intermodal revenue movements that both originate and terminate within the United States. These intermodal figures are further segmented into ISO container moves (i.e., international) and domestic equipment moves (i.e., domestic container and trailer).

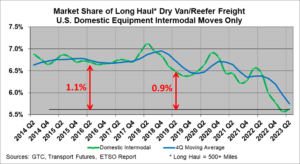

Intermodal share tumbles from Q2 2018 peak

Intermodal rail market share of US long-haul dry-van and refrigerated freight, domestic equipment moves only

What happens to the international intermodal sector and the share of US long-haul truckloads it commands is, to a significant extent, the product of outside forces. How fast are import and export TEUs growing versus US truckloads? Where are these TEUs entering and exiting the nation? What are the steamship line policies and their interest level in extending their services inland? These and many more inputs to international intermodal demand are difficult for the intermodal sector to affect. Therefore, let’s set international intermodal aside for this discussion.

But the story is quite different regarding domestic intermodal. Here, it’s all about the industry’s competitive posture vs. truck. It’s about service levels, capacity and above all, economics.

The chart tracks domestic intermodal’s share of long-haul truckload volume over the past 10 years. As they are economically derived figures, the truckload numbers are necessarily imprecise. But for the purposes of this calculation, they are enough in the ballpark to make an important point. It’s not so much the exact numbers as it is the trend.

The chart, more than any other, quantifies the extent of the damage the domestic intermodal sector has endured in recent years. In the second quarter of 2023, the US domestic intermodal share of long-haul truck stood at an estimated 5.63%. The share has dropped 0.86 percentage points since the second quarter of the last “normal” year, 2019. What that means is that if the industry had simply hung onto the share that it achieved in 2019, the Q2 domestic volume in 2023 would have been more than 15% higher. Applying this to the North American Q2 domestic volume of 2.15 million revenue moves, this would have meant an additional 327,000 loads. Annualize that figure and you’re looking at an additional 1.3 million domestic revenue moves this year.

Same conditions as 2019

There’s a lot of discussion right now regarding the intermodal headwinds being generated by soft freight demand and abundant truck capacity. These “abnormal” conditions, we are told, are what’s holding back intermodal growth. But if you go back to 2019, you’ll find the exact same conditions were in play. Trucking was coming off the historic capacity crisis linked to electronic logging devices (ELDs). Truck capacity had flowed into the system, and truck rates were coming down. Sound familiar?

What if we went back further? In the “good old days” prior to 2018, domestic intermodal amply demonstrated its ability to maintain share near 6.7%, hanging at about that level for over three years from 2015 into 2018. This predates much of the precision scheduled railroading (PSR) restructuring of the intermodal network and a good chunk of the de-marketing/conversion of trailer-on-flatcar (TOFC). The share difference from Q2 2023 stands at about 1.1 percentage points. Had that 6.7% share been achieved in the second quarter, domestic volume would have been 19.5% higher, translating into another 408,000 domestic revenue moves, or about 1.6 million more annual loads on the rail.

What might this mean in terms of revenue? The Intermodal Savings Index compiled by the Journal of Commerce indicates average intermodal rates recently were running about $1.65 per mile. I have calculated that the average domestic intermodal length of haul in the second quarter was 1,472 miles. Average revenue per load, therefore, was approximately $2,444. Run the math on 1.6 million loads and that means the industry would have generated an additional $4 billion dollars in annualized revenue had it achieved a 6.7% domestic intermodal market share in the second quarter.

‘Pivot to growth’

There has been a lot of talk lately about the “pivot to growth.” To achieve growth, the intermodal sector needs to make a close analysis of why this market share has been lost. What has changed and how can that process be reversed? Has the truckload freight market changed in some fundamental manner? I don’t think so. Or is it domestic intermodal that has changed?

Set aside those brief and relatively infrequent periods when truck capacity is really tight. That’s not “normal,” no matter how much the intermodal sector would like it to be. History tells us that intermodal success during truly normal times is a proposition that is simple to describe, although difficult to execute. It involves reliable service with a door-to-door on-time percentage in the low 90s or high 80s, schedules that get the freight to destination within one to three days longer than truck (depending on length of haul) and door-to-door savings per package, pallet or carton of at least 10% to 15%.

The marketplace is giving the intermodal sector a clear message. The industry has a choice: continue to wait for market conditions to improve and settle for — at best — small gains or go back to basics and recreate the success that has previously been attained.

If $4 billion is not enough to motivate us, what will it take?

Contact Larry Gross at lgross@intermodalindepth.com.